Utility vehicles share in India rose to 48 % during 9 months of Fiscal 22

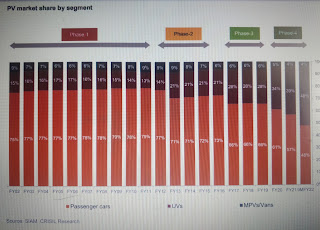

Share of utility vehicles (UVs) in the overall domestic passenger vehicle (PV) segment increased to 48% in the first nine months of fiscal 2022 from 15% about two decades ago (fiscal 2002), about 3,300 basis points (bps) jump, according to Crisil's research.

Industry experts said "this generally follows the US pattern of switch over to UV compared to sedans. The UVs have become more sophisticated and have attained a status symbol. India will follow this path".

Crisil's report shows the share of small cars declined from

65% in fiscal 2012 to 45% in the first nine months of fiscal 2022. This shift

was felt more so in fiscals 2021 and 2022 as income sentiments of entry level

car buyers has been impacted due to Covid-19 which has also led to a spurt in

UV sales share.

Clearly consumer preference towards UVs, contrary to the

long-held view that India is a small cars market. The share of UVs in the PV

market has risen steadily over the past decade, riding on new launches at

attractive price points, GST differential leading to increased sales of sub 4m

compact UV and changing consumer preferences.

The role of UVs transitioned structurally from commercial to

personal mainly over phases 3 and 4, increasing their penetration. UVs have

evolved from being a typical off-road 4WD diesel vehicle with ladder-on-frame

construction to an on-road 2WD/4WD, petrol/diesel vehicle with unibody

architecture, driven in cities/ highways and never on muddy fields — a change

that has fuelled growth.

Number of models in the UV space increased to 68 in fiscal

2020 from 42 in fiscal 2013. In contrast, the small car segment models declined

to 26 in the first nine months of fiscal 2022 from 42 in fiscal 2017.

Crisil report showed an overlap in prices between the small

car segment and compact UVs. Thus, consumers have a variety of options across

segments at different price points.

For long, the market has been skewed towards small car segments — including micro, mini and compact vehicles whose lengths vary from 3,200 mm to 4,000 mm — which have predictably drawn the most action from OEMs.

Recent years, however, have seen a major shift in consumer

preference, especially in urban areas. Between fiscals 2009 and 2019, the small

car segment logged a compound annual growth rate (CAGR) of 7%, while UVs —

defined as either four-wheel-drive (4WD) or two-wheel-drive (2WD) vehicles

having off-road capability and lengths of 3,800mm to 5,100 mm — logged a CAGR

of 16%. While a part this growth is due to low-base effect, the entry of new

players and launch of new models have also pushed the change in consumer bent.

The rising share of UVs in the Indian PV market mirrors the

trend in international markets. The share of UVs in the domestic market

increased to 34% in CY2019 from ~11% in CY2010 vis-à-vis an increase to ~41% in

2019 from ~17% in CY2010 in global automobile markets. The US and Europe have

leading shares of UVs in the global PV market, according to Crisil.

Hence, GST differential among different sub-segments which

led to increased model launches in the sub4m/compact UVs category of PVs,

launch of UVs at comparable prices, changing consumer preference and decrease in

weighted average UV prices in fiscal 2021 have boosted the share of UVs

increasing to 39% in fiscal 2021 and to 48% in the first nine months of fiscal

2022.

Lately, the semiconductor shortage that has impacted

production of small car market leader Maruti Suzuki, has also led to an optical

decrease in the share of small cars and increase in the share of UVs. The

uptick in the segment is expected to continue in the near term given all the

major upcoming launches are in this segment.

Crisil expects, between fiscals 2021 and 2026, UVs to

outperform other segments and log a CAGR of 14-18% compared with just 4-6% in

small cars. They also expect the share of the UV market to increase gradually

to 51-53% in fiscal 2026 from ~39% in fiscal 2021.

Comments