VC investment in India dipped in Q2’22, but up YoY, says KPMG report

Source; Q2’22 edition of Venture Pulse

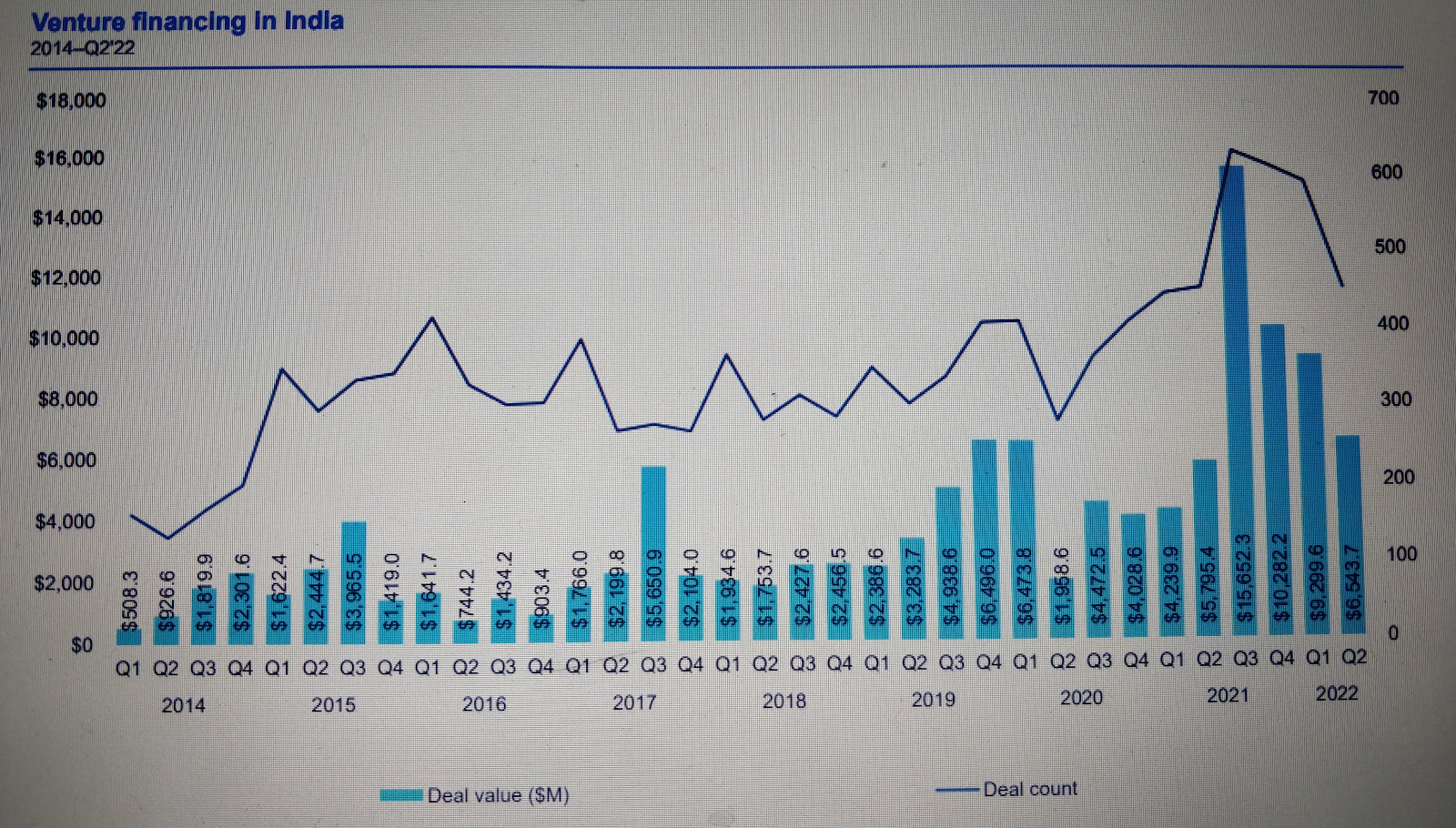

VC investment in India dipped sequentially in Q2’22, driven in part by global geopolitical uncertainties and rising inflation. Venture financing in India surpasses $6.5 billion for the 4th consecutive quarter.

During Q1 the country attracted $9.2 billion and $5.7 billion during the Q2 of last year, according to Q2’22 edition of Venture Pulse — a quarterly report, published by KPMG Private Enterprise, that analyzes key VC deals and trends globally.

The largest raises outside of the US included a $805 million raise by India-based Dailyhunt. This is also the largest round of the quarter in Asia. In Asia, top 10 deals spread between China (5), India (4), Indonesia (1), Singapore (1).

Other major fund raising includes $300 million lage-stage VC by Pune-based Xpressbees, $270 million Series C by Delhi-based fintech Stashfin.

Nitish Poddar, Partner and National Leader, Private Equity KPMG in India quoted in the report saying "in India, the funding hasn’t dried up yet, but many startups are taking proactive steps to reduce their cash burn given the increase in federal interest rates, the crisis in Ukraine, and other evolving issues. Because they anticipate challenges raising funding and expect investors will increasingly ask for paths to profitability and better cash conservation, they’re doing what they can to improve their operating position now so they can potentially avoid drastic changes later.”

VC-backed companies in India shifted their focus to cash preservation in anticipation of funding becoming less easy to obtain over the next few quarters and VC investors requiring companies to strengthen their paths to profitability and lower their cash burn

Fintech remained the hottest area of investment in India during the quarter, in addition to e-commerce, social commerce, and gaming

Agritech also attracted a growing number of deals in Q2’22; while the majority of these deals occurred at very early deal stages, the space is expected to see deal sizes grow as the sector evolves

While VC investment in India may be muted over the next quarter or two due to the global reduction in money supply and other factors, the country is expected to remain quite attractive to VC investors over the medium to longer term due to its relatively positive macroeconomic environment and market demographics.

ends

Comments